Thank you for choosing the Foundation to express your generosity!

Click here to download a printable donation form or click the relevant image below to donate online:

Visit the Foundation’s donation hub on … ![]()

Uplifting Young Methodists Scholarship

Uplifting Young Methodists Scholarship

Join others in granting annual scholarships to minority students.

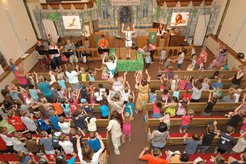

Creative Ministries Grants

Creative Ministries Grants

Empower local churches and organizations with annual grants.

Northern Illinois Conference United Methodist Men

Northern Illinois Conference United Methodist Men

Support the missions of United Methodist Men.

![]() If you would like to donate securities (stocks, bonds, mutual funds, ETFs) to the Foundation, which you can designate to benefit the Foundation or one of the Foundation’s partners, such as your local church or other organization aligned with the values of the Foundation, visit the “Donate Securities” page.

If you would like to donate securities (stocks, bonds, mutual funds, ETFs) to the Foundation, which you can designate to benefit the Foundation or one of the Foundation’s partners, such as your local church or other organization aligned with the values of the Foundation, visit the “Donate Securities” page.

Midwest Methodist Foundation

155 North Wacker Drive, Suite 4250

Chicago, IL 60606

The Foundation is a 501(c)(3) public charity. Donations to the Foundation are tax deductible according to IRS guidelines.