Simplify your church’s investments through three funds.

Allocating Assets through Diversification & Portfolio Optimization

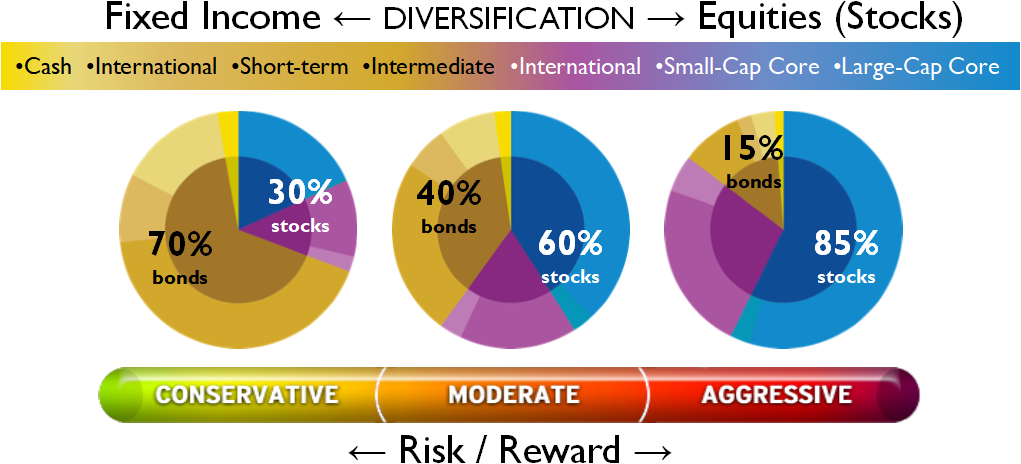

The Foundation offers to our investment clients three fund models that are broadly diversified and optimized to fulfill SRI & ESG objectives. The three fund names—Conservative, Moderate, and Aggressive—reflect their relative risk / return profiles. The pie charts below depict the asset allocations of the funds and their target percentages.

The three funds invest in the same seven portfolio components.

By investing in one, two, or all three of the funds, your church can customize the church’s risk / reward profile while remaining diversified across the same seven portfolios. By investing through the Foundation, you free up church staff and leadership to be more fully engaged in mission and ministry. The Foundation is at “arm’s length,” which promotes a long-term mindset and ameliorates conflicts of interest and adverse decision-making.

Visit another page under Investment Overview:

Investment Overview Main Page

About the United Methodist Foundation

Value Comparison to Secular Advisors

Sustainable and Socially Responsible

Investment Partner & Services Provider