Put the best of the markets to work for your church.

Aligning Investments with Sustainable Priorities

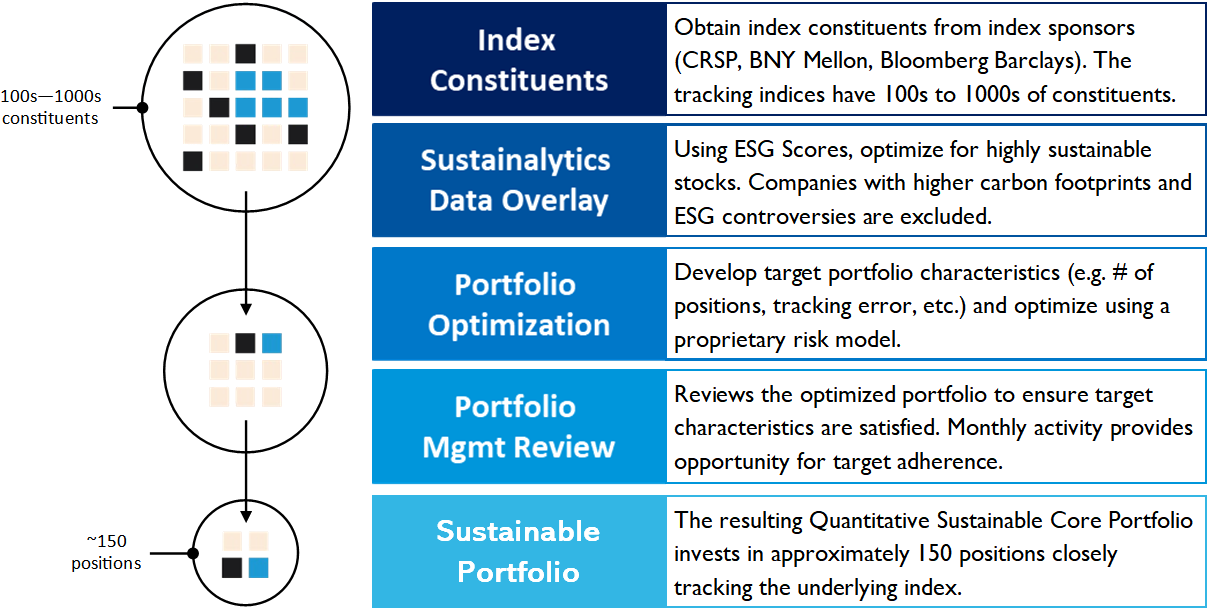

Each portfolio contains a subset of the constituents of a major market index and is designed to mimic the portfolio characteristics of the index as a whole.

Beginning 2018 the Foundation’s fund models contain four Quantitative Sustainable Portfolios to diversify exposure to a wide-range of companies:

- Quantitative Portfolio: Sustainable Large Cap Core Portfolio

- Quantitative Portfolio: Sustainable Small Cap Core Portfolio

- Quantitative Portfolio: Sustainable International ADR Portfolio

- Quantitative Portfolio: Sustainable Emerging Markets ADR Portfolio

Additionally, each fund model contains three more portfolios for exposure to a wide-rage of fixed income (bonds): intermediate, short-term, and foreign.

Graphics and methodology description: ©2018 Envestnet | PMC. All rights reserved.

Visit another page under Investment Overview:

Investment Overview Main Page

About the United Methodist Foundation

Value Comparison to Secular Advisors

Sustainable and Socially Responsible

Investment Partner & Services Provider (back)